kern county tax collector change of address

KCTTC 1115 Truxtun Ave. Change a Mailing Address Kern County Assessor-Recorder.

Assessor-Recorder Kern County CA.

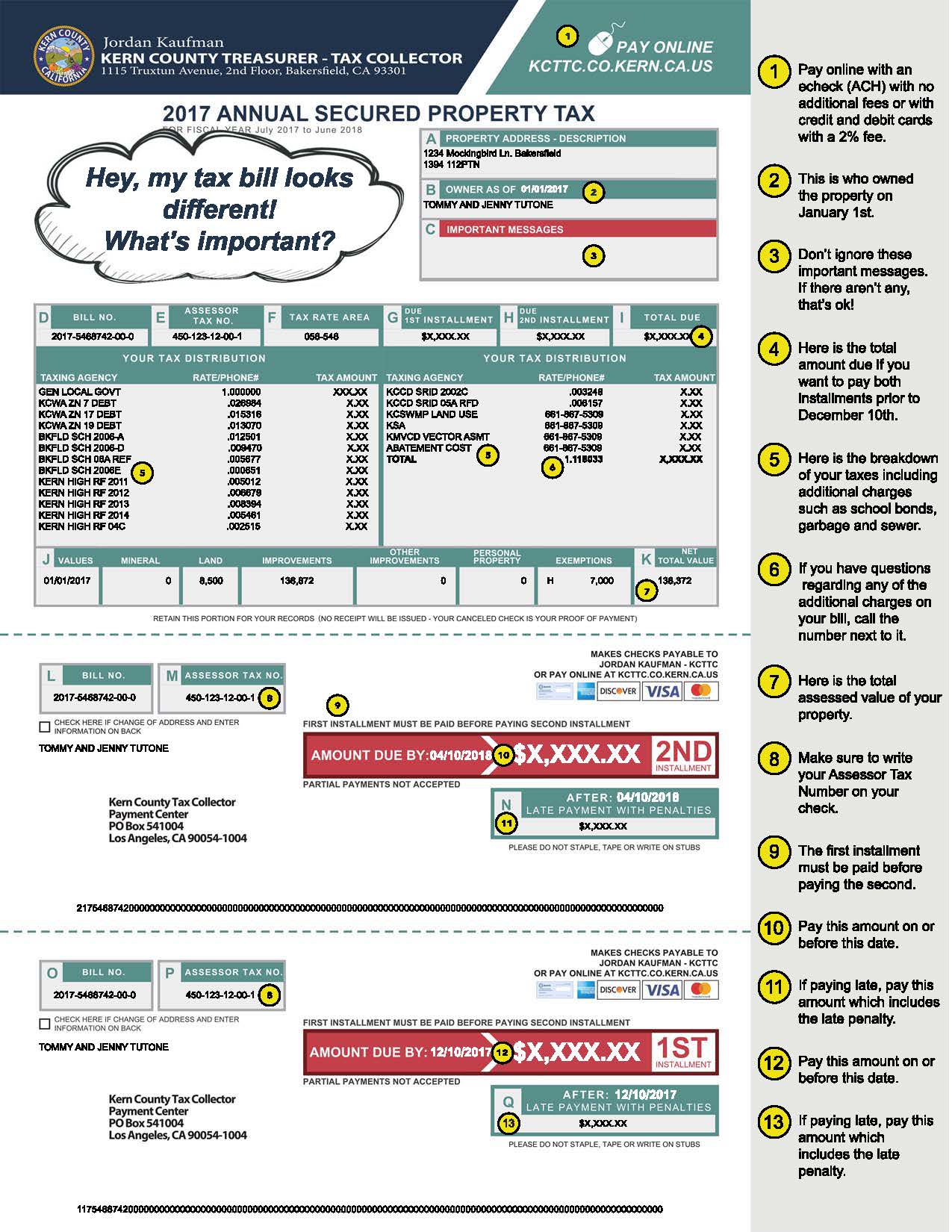

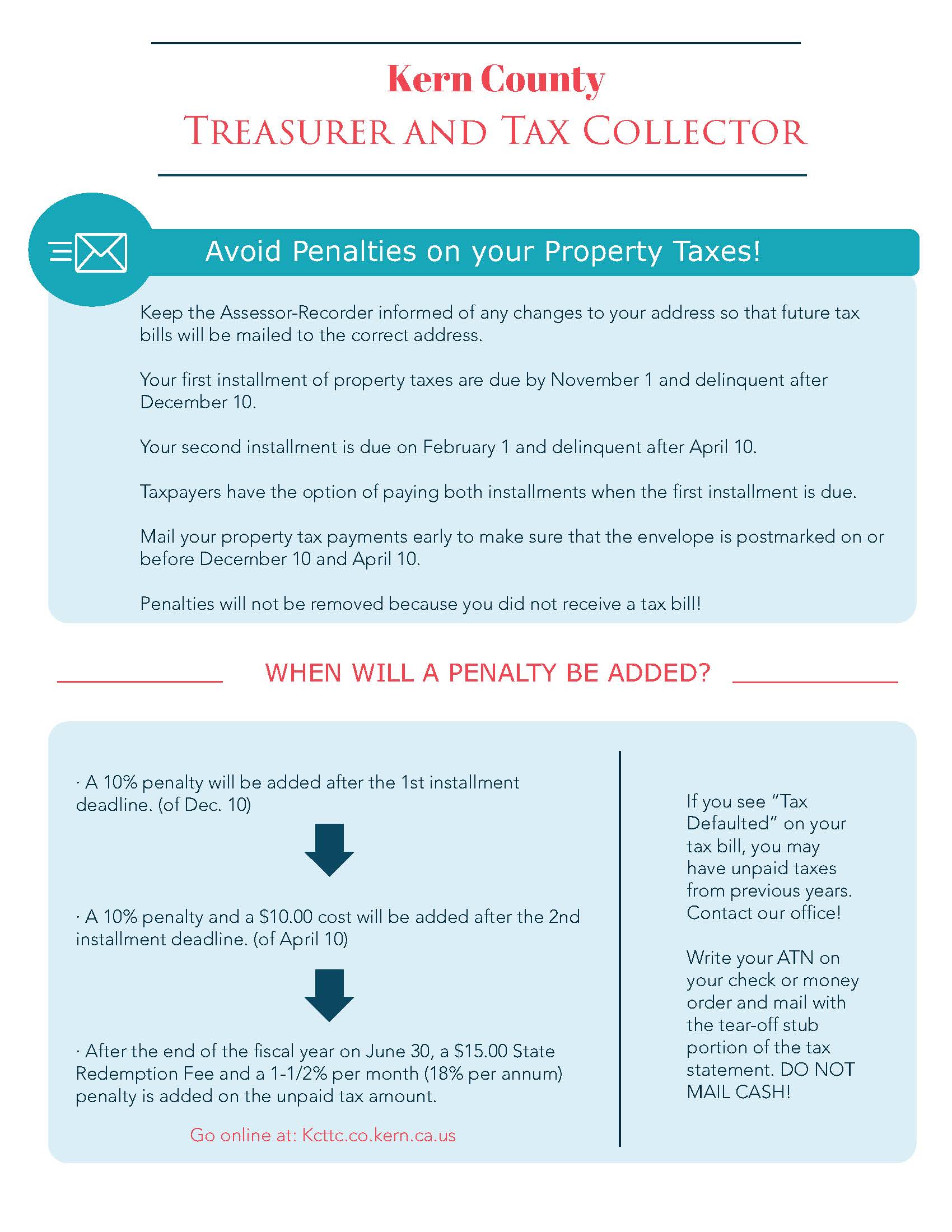

. Online Visit the Superior Court of California County of Kern website to file your documents online. The Treasurer-Tax Collector collects the taxes for the County all public schools incorporated cities and most other governmental agencies within the County. The form required when changing your mailing address is available on the Cal Assessor e-Forms website.

Application for Tax Penalty Relief. COUNTY OF KERN ASSESSORS OFFICE CHANGE OF MAILING ADDRESS REQUEST FORM IMPORTANT. You must be the current property owner in order to change the mailing address.

This is referred to as the tax capThe Assessors Office recently mailed out Tax Cap Abatement Notices to residential property owners who purchased property or had a change in ownership. File an Assessment Appeal. Apr 04 2022 KERN COUNTY ASSESSOR CHANGE OF ADDRESS FORM Please Type or Print Property valuation information and tax bills are mailed to the address contained in Assessors.

KERN COUNTY ASSESSOR CHANGE OF ADDRESS FORM 2nd Page Please. Exclusions Exemptions Property Tax Relief. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office.

Serve the divorce papers Anyone whos not involved in the case and is over 18 can. Box 579 Bakersfield CA 93302-0580. Business Personal Property.

Request For Escape Assessment Installment Plan. We hope this information will be helpful to taxpayers in Kern County. Payments can be made on this website or mailed to our payment processing center at PO.

You may contact the Kern County. Name Kern County Assessors Office Address 1115 Truxtun Avenue Bakersfield California 93301 Phone. Internet Tax Payment System.

Enter an 8 or 9 digit APN number with or without the dashes. 2221 Kern Street Fresno. Application for Tax Relief for Military Personnel.

Establecer un Plan de Pagos. Change a Mailing Address. Information about Proposition 19 available from the Office of the Taxpayers Rights Advocate.

Enter a 10 or 11 digit ATN number with or without the dashes. Property valuation information and tax bills are mailed to the address contained in Assessors Office records. How to Use the Property Search.

File an Exemption or Exclusion. KCTTC Taxpayer Service Center PO. Box 541004 Los Angeles CA 90054-1004.

Supplemental Assessments Supplemental Tax Bills. Kern County Treasurer And Tax Collector Change of Address Handled by the Assessors Office Application to Reapply Erroneous Tax Payment. Kern County Treasurer-Tax Collectors Office Address 1115 Truxtun Avenue Bakersfield California 93301 Phone 661-868-3490 Fax 661-868-3409.

Kern County Department Of Human Services Kerncountydhs Twitter

Kern County Treasurer And Tax Collector

Assessor Recorder Kern County Ca

Kern County Treasurer And Tax Collector

Adopted Budget Fy California County Financial Documents Digital Resources For Law And Public Policy

Kern County Treasurer And Tax Collector

Our View Kern County Races Can Be Decided In June Primary Opinion Bakersfield Com

How To Transfer A Mobile Home Title In California Mobile Home Investing

Pay Your Property Taxes Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Grand Jury Final Report California Grand Jury Reports Digital Resources For Law And Public Policy

Thousands Of Kern County Pg E Customers To Be Moved To Time Of Use Plans Youtube

Business Property Statement For 2010 Kern County Assessor

Our View Kern County Races Can Be Decided In June Primary Opinion Bakersfield Com

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector